Why we invested in SBET: The starting point of a new era of CeDeFi integration

Preface

This article was written in May 2025. During that month, we completed a PIPE investment in SharpLink—a milestone in our focused research on the PIPE market since the beginning of the year. Since early 2025, Primitive Ventures has strategically positioned itself to capture the CeDeFi convergence trend, proactively focusing on Digital Asset Treasury PIPE transactions. Within this framework, we systematically analyzed all major deals, with SharpLink representing the most significant and representative transaction in which we have participated to date.

Full Article

We are pleased to announce that Primitive Ventures participated in SharpLink Gaming, Inc. (NASDAQ: SBET)’s $425 million PIPE (Private Investment in Public Equity) transaction. This investment provides unique exposure to a company natively focused on holding Ethereum as a corporate treasury asset. The investment structure features option-style characteristics and long-term capital appreciation potential, reflecting our strong conviction in Ethereum’s strategic role in U.S. capital markets. This aligns with our overall thesis regarding the institutional adoption of crypto assets.

Our Investment Rationale

ETH vs. BTC: The Productive Value Divide

In contrast to BTC, which does not generate native yield, Ethereum is inherently a yield-bearing asset capable of producing staking returns. BTC strategies—such as those employed by MicroStrategy—primarily rely on leveraged acquisitions and do not capture native asset yields, resulting in higher leverage risk. SBET, however, can directly utilize ETH staking rewards and DeFi opportunities, achieving on-chain compounding and delivering tangible value to shareholders.

Currently, no ETH staking ETF has been approved under existing regulations, so public markets cannot access Ethereum’s yield potential. SBET presents a differentiated approach: with Consensys’ support, the company is positioned to implement protocol-native strategies and generate substantial on-chain returns, with a model that could outperform future ETH staking ETFs.

Additionally, Ethereum’s implied volatility (69) is significantly higher than Bitcoin’s (43), introducing asymmetric upside optionality into equity-linked structures. This dynamic is particularly attractive for investors pursuing convertible arbitrage and structured derivatives strategies, as volatility can be monetized as an asset rather than regarded solely as a source of risk.

Consensys’ Strategic Role

We are proud to work with Consensys, the lead investor in this $425 million PIPE round. As Ethereum’s leading commercial execution platform, Consensys brings distinct advantages in technical leadership, product ecosystem depth, and operational scale, making it the ideal partner to advance SBET as a top Ethereum-native public company.

Founded in 2014 by Ethereum co-founder Joe Lubin, Consensys has played a pivotal role in transforming Ethereum’s open-source foundation into scalable, real-world applications—from the EVM and zkEVM (Linea) to MetaMask, which has onboarded tens of millions of users into Web3. Consensys has raised over $700 million from leading institutions such as ParaFi and Pantera and has a proven track record in strategic acquisitions, cementing its status as the most deeply integrated commercial operator in the Ethereum ecosystem.

Joe Lubin’s position as Chairman goes beyond a symbolic role. As a co-architect of Ethereum’s core design and a key leader in infrastructure, Joe brings unique and comprehensive insight into Ethereum’s product roadmap and asset structure. His early Wall Street experience also provides the expertise needed to guide SBET’s integration into institutional capital markets.

With SBET, there is a rare combination of a differentiated asset and a leading strategic investor. This partnership fosters a strong positive cycle—treasury strategies built on protocol-level mechanisms, supported by experienced protocol leadership. Under Consensys’ guidance, SBET is positioned to become a flagship example of how productive Ethereum capital can be institutionalized and scaled within traditional public markets.

Market Valuation Comparison

To assess SBET’s investment opportunity, we analyzed the crypto treasury strategies of various public companies:

MicroStrategy: The Pioneer in Crypto Treasury Strategy

MicroStrategy set the industry benchmark for crypto treasury strategies. As of May 2025, it held 580,250 BTC, valued at approximately $63.7 billion, making it the market leader. MSTR’s strategy involves issuing low-cost debt and equity to purchase Bitcoin, sparking a wave of corporate imitation and demonstrating the viability of crypto assets as treasury holdings.

As of May 2025, MSTR’s 580,250 BTC (about $63.7 billion) allowed its stock to trade at 1.78x mNAV (market cap/net asset value), underscoring strong investor demand for regulated, leveraged crypto exposure through public equity. This premium is driven by factors such as leverage, index eligibility, and greater accessibility compared to direct BTC ownership.

From August 2022 to August 2025, MSTR’s mNAV ranged from 1x to 4.5x. Higher multiples coincided with Bitcoin bull markets and major MSTR purchases, reflecting elevated investor optimism. Multiples reverted to 1x during periods of market consolidation and shifts in investor sentiment.

Peer Comparison

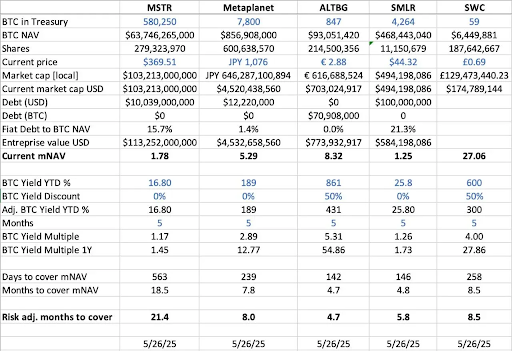

We benchmarked several public companies with BTC treasury strategies:

- By BTC net asset value (BTC NAV)—the total value of BTC held—MicroStrategy leads with 580,250 BTC (~$63.7B), followed by Metaplanet (7,800 BTC, ~$857M), SMLR (4,264 BTC, ~$468M), ALTBG (847 BTC, ~$93M), and SWC (59 BTC, ~$6.4M).

- For the market cap to BTC NAV ratio (mNAV), SWC has the highest premium at 27.06x, largely due to its small holdings and strong market enthusiasm. ALTBG’s mNAV is 8.32x, Metaplanet’s is 5.29x—both relatively high. MSTR’s is 1.78x, and SMLR’s is 1.25x, reflecting their larger asset bases and the presence of debt, resulting in more moderate premiums.

- Year-to-date BTC yield per share (adjusted for dilution) is higher for smaller-cap companies due to continued accumulation—ALTBG at 431%, SWC at 300%—demonstrating greater capital efficiency and compounding ability.

- At current BTC growth rates (Days/Months to cover mNAV), ALTBG and SMLR could theoretically accumulate enough BTC to cover their current mNAV premium in five months, presenting potential alpha for NAV convergence trading and relative value opportunities.

- In terms of risk, MSTR and SMLR have debt accounting for 15.7% and 21.3% of their BTC NAV, respectively, increasing risk in a BTC downturn. ALTBG and SWC carry no debt, offering greater risk control.

Japan’s Metaplanet: Regional Market Valuation Arbitrage

Valuation differences often result from variations in reserve asset scale and capital structure. However, the dynamics of regional capital markets are equally important. Metaplanet, often referred to as “Japan’s MicroStrategy,” is a notable example.

Its valuation premium is driven not only by its BTC holdings but also by several structural advantages specific to the Japanese market:

- NISA tax incentives: Japanese retail investors actively allocate to Metaplanet shares through NISA (Nippon Individual Savings Account). NISA allows up to approximately $25,000 in tax-free capital gains, which is far more attractive than facing up to a 55% tax on direct BTC holdings. According to SBI Securities, as of the week of May 26, 2025, Metaplanet was the most purchased stock in all NISA accounts, driving a 224% share price increase in the past month.

- Distorted Japanese bond market: Japan’s debt-to-GDP ratio stands at 235%, and 30-year JGB yields have risen to 3.20%, indicating structural pressure in the bond market. Against this backdrop, investors increasingly view Metaplanet’s 7,800 BTC as a macro hedge against yen depreciation and domestic inflation.

SBET: Building a Global ETH Leader

In public markets, regional capital flows, tax systems, investor psychology, and macroeconomic conditions are as critical as the underlying asset. Understanding these jurisdictional differences is essential to identifying asymmetric opportunities at the intersection of crypto assets and public equities.

As the first public company focused on ETH as a core capital asset, SBET also stands to benefit from strategic jurisdictional arbitrage. SBET could further unlock liquidity and strengthen narrative resilience through dual listings in Asian markets (such as HKEX or the Nikkei). This cross-market strategy will help SBET establish itself as the world’s leading Ethereum-native public asset, earning institutional recognition and participation globally.

The Institutionalization of Crypto Capital Structure

The integration of CeFi and DeFi marks a turning point in the evolution of crypto markets, signaling increasing maturity and gradual assimilation into the broader financial system. Protocols like Ethena and Bouncebit, which combine centralized elements with on-chain mechanisms, are expanding the utility and accessibility of digital assets, illustrating this trend.

At the same time, the convergence of crypto assets with traditional capital markets reflects a deeper macro-financial transformation: crypto assets are increasingly recognized as a compliant, institution-grade asset class. This evolution can be divided into three main stages, each representing a leap in market maturity:

- GBTC: As one of the earliest institutional BTC vehicles, GBTC offered regulated market exposure but lacked a redemption mechanism, resulting in persistent price deviations from NAV. While pioneering, it revealed structural limitations of legacy financial wrappers.

- Spot BTC ETFs: Since SEC approval in January 2024, spot ETFs have introduced daily creation and redemption mechanisms, enabling prices to closely track NAV and enhancing liquidity and institutional participation. However, as passive vehicles, they do not capture core native value drivers such as staking, yield, or active value creation.

- Corporate treasury strategies: Companies like MicroStrategy, Metaplanet, and now SharpLink are taking the next step by incorporating crypto assets into their treasury operations. This approach goes beyond passive holding, utilizing compounding, tokenization, and on-chain cash flow generation to enhance capital efficiency and drive shareholder value.

From the rigid structure of GBTC to the mechanical innovations of spot ETFs and now the rise of yield-optimized treasury models, crypto assets are becoming increasingly integrated into modern capital markets—driving greater liquidity, sophistication, and opportunities for value creation.

Risk Notice

While we maintain strong confidence in SBET, we remain mindful of two primary risks:

- Premium compression risk: If SBET’s share price remains below its net asset value, future equity financing could dilute existing shareholders.

- ETF substitution risk: Should an ETH ETF with staking capability be approved, it could provide a simpler, compliant alternative and divert capital away from SBET.

Nonetheless, SBET’s ability to generate native ETH yield should enable it to outperform ETH ETFs over the long term, combining growth and income potential.

In summary, our $425 million PIPE investment in SharpLink Gaming is based on a firm belief in Ethereum’s strategic value within corporate treasury strategies. With the support of Consensys and leadership from Joe Lubin, SBET is positioned to represent the next phase of crypto value creation. As CeFi and DeFi converge to reshape global markets, we will continue to support SBET in achieving long-term, superior returns and fulfilling our mission to identify high-potential opportunities.

Legal Notice:

- This article is reprinted from [TechFlow] with copyright belonging to the original authors: [Yetta (@yettasing), Partner at Primitive Ventures;

Sean Tan, Liquidity Partner at Primitive Ventures, former Macro Portfolio Manager at Tower Research]. For reprint objections, please contact the Gate Learn team; we will process your request promptly. - Disclaimer: The views and opinions expressed are solely those of the authors and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without explicit reference to Gate, reproduction, redistribution, or plagiarism of the translated article is prohibited.