EOS Revamps with Vaulta: From ETH Killer to Web3 Bank

Over the years, the blockchain industry has seen its fair share of booms and busts, with countless projects enjoying moments of fame or fading into obscurity. If we’re talking about both triumph and controversy, EOS undoubtedly ranks near the top. Once hailed as a “superstar project” for raising $4.2 billion in a single year, this public chain captured global attention and anticipation.

Yet change is the only constant in blockchain. As the market evolved and user preferences shifted, EOS gradually lost its edge, exposing a range of issues and falling behind in both community governance and ecosystem development. In this new era, EOS has become more of a topic of casual conversation than the trailblazer it once was.

To shed this legacy and reinvent itself, the EOS team announced a full rebrand to Vaulta. This wasn’t just about escaping negative perceptions or regaining investor confidence—it was a deliberate move to break through the limitations of the past. Vaulta is no longer pitching itself as a high-performance public chain but is firmly focused on building a “Web3 banking operating system” for financial institutions and compliant users.

EOS Reshapes Next-Generation Financial Infrastructure as Vaulta

Behind the EOS rebrand lies sharp insight into industry trends. Previously, blockchain competition centered on technical enhancements like TPS (transactions per second) and consensus mechanisms. But as stablecoins became mainstream, RWA (real-world asset) applications took off, cross-border payments surged, and global regulations matured, the industry inevitably hit a turning point—shifting toward building foundational financial infrastructure with tangible value. Blockchain now serves to support financial systems and the broader ecosystems they enable.

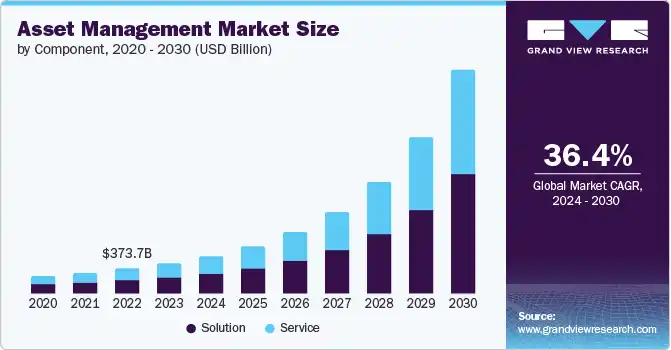

Grand View Research reports that since 2020, the global crypto user base has grown by a compound annual rate of 34%, with 18- to 34-year-olds as the dominant demographic. This generation’s openness to financial digitization far exceeds previous cohorts. By 2028, cross-border stablecoin payments are projected to account for nearly 73% of all stablecoin transactions globally. In this landscape, the shortcomings of traditional payments are even more apparent: the average global remittance fee is around 6.65%, while blockchain can slash that below 0.1% and compress settlement times from days to seconds—unlocking unprecedented capital efficiency worldwide.

Vaulta was born out of this industry evolution. It builds on EOS’s legacy of high-performance blockchain engineering while embracing compliance, sustainability, and real-world utility as core pillars. The “Vaulta” name comes from “vault,” signifying security and trust in DeFi. Rather than a simple rebrand, Vaulta marks a systemic overhaul from the ground up.

Vaulta’s innovations begin with a new token model, featuring a halving mechanism and multiple project funds to strengthen long-term sustainability and governance. Alongside its high-performance DPoS architecture, Vaulta has rewritten and expanded key system modules to deliver zero downtime and immediate transaction finality.

By optimizing consensus mechanisms and node sync strategies, Vaulta can maintain stable operations—even during network spikes or node failures. Transactions are confirmed almost instantly, supporting financial-grade applications such as payments and settlements. Its “Web3 banking operating system” introduces modular accounts, IBC (inter-blockchain communication) standards for multi-chain interoperability, and a multi-environment compatibility layer that allows developers to build EVM and non-EVM on-chain banking apps. For enterprise-grade custody and asset protection, Vaulta has formed partnerships with regulated custodians like Ceffu and Tetra Trust.

Vaulta’s Web3 banking operating system also includes essential functions found in traditional financial systems—account management, access control, and audit tools—ensuring efficient operations and full on-chain asset traceability across the network.

EOS’s rebrand isn’t just about “a faster blockchain.” It represents a deeper rethink: building the next generation of financial infrastructure.

Global Expansion and Real-World Adoption

Perhaps learning from the EOS era, the Vaulta team has accelerated global expansion since its launch, pushing rapid business adoption through diverse institutional partnerships.

As a cornerstone of the Vaulta ecosystem, the Bitcoin-focused digital banking platform exSat Bank debuted alongside the brand relaunch. exSat Bank breaks down barriers between traditional and crypto finance, integrating asset management, payments, trading, and risk controls within one Web3 banking operating system. Users can handle asset storage, yield earning, transfers, and payments—all from a single account, eliminating the need to switch between platforms.

Vaulta’s most high-profile collaboration is with World Liberty Financial (WLFI), backed by the Trump family. In May 2025, WLFI purchased $6 million of Vaulta tokens and announced a long-term partnership. WLFI will bring its USD1 stablecoin onto the Vaulta network, with both parties working together to advance compliant Web3 finance on a global scale.

Vaulta also announced a strategic partnership with Fosun Wealth Holdings, part of China’s Fosun Group, to deliver blockchain financial infrastructure for Hong Kong’s market. Vaulta will provide its complete Web3 banking operating system suite—including exSat—to support Fosun’s virtual asset business “FinChain” with tools for asset issuance, yield generation, and crypto payments. Fosun, in turn, will leverage its global licenses and RWA issuance capabilities to enable compliant scaling on the platform. According to Vaulta Foundation founder and CEO Yves La Rose, this collaboration is a key milestone for Vaulta’s global Web3 banking vision.

On the crypto-native side, Vaulta is collaborating with leading platforms. For example, Vaulta and Ultra—a decentralized gaming platform built on EOS tech—have agreed to make Vaulta the backbone for Ultra’s payments and digital asset custody. By combining Vaulta’s high-throughput, low-latency network with Ultra’s active user base, they will jointly create a next-gen gaming platform with cross-title asset transfers, NFT finance, and on-chain rewards.

Vaulta has also joined forces with Canadian digital asset platform VirgoCX to launch VirgoPay, a cross-border payment solution. VirgoPay serves as a proof-of-concept (POC) for Vaulta’s cross-border capabilities within its Web3 banking operating system. The Vaulta network will serve as VirgoPay’s default settlement layer, delivering faster and more reliable transactions than legacy channels. Through stablecoin and bank integration, VirgoPay promises near-instant, ultra-low-cost global remittances. To date, VirgoCX has processed over 2.5 billion Canadian dollars in transactions and is expected to hit a record-breaking CAD 3.5 billion in annual volume by 2025. VirgoPay’s initial rollout covers major markets including the US, Hong Kong, Canada, Brazil, and Australia, with plans to expand into Southeast Asia, the Middle East, and other emerging regions—targeting the trillion-dollar global cross-border payments market.

Web3 Banking: Real Progress, Real Capital

Since Vaulta’s rebranding push, its ecosystem has attracted significant capital inflows, reflected in its token’s robust performance this April. While the token (now $A) has since entered a consolidation phase, Vaulta’s ecosystem continues to expand at pace.

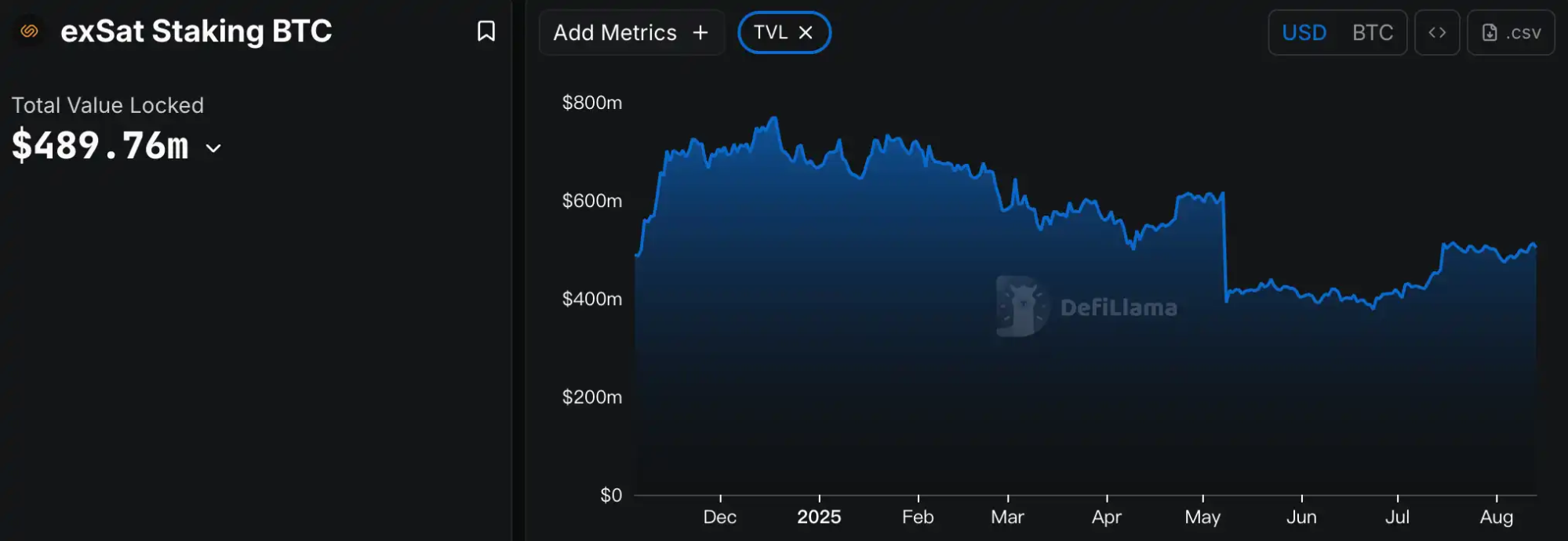

Vaulta’s current TVL is $196 million, and it hit an all-time high of $384 million on May 17. exSat, as a Bitcoin-based digital bank and service provider, is Vaulta’s flagship decentralized application, built on Vaulta’s mainnet and forked from its EVM architecture. exSat alone boasts a TVL exceeding $489 million. Combine that with Vaulta’s, and the network’s total TVL reaches $685 million—putting Vaulta in the global top 20 public chains by TVL.

Within exSat’s ecosystem, exSat Bank is the core financial service platform, giving institutions and individuals access to digital asset lending, cross-chain settlements, stablecoin issuance, asset custody, and more. Vaulta’s Web3 banking operating system modules can also enhance legacy banking infrastructure with on-chain asset management, cross-border settlements, and compliance auditing.

Vaulta’s developer activity has also seen a sharp uptick, hitting new yearly highs.

Blockchain Infrastructure Poised for a Breakout

In short, Vaulta has evolved from EOS and now aims far beyond simply being a high-performance public chain. It is positioning itself as an architect of the next generation of Web3 financial infrastructure—a fundamental rethink and proactive response to the logic driving the global financial system.

The “Web3 bank” concept proposed by Vaulta isn’t just about porting traditional banking on-chain. It’s a structural reinvention: merging on-chain finance’s openness with the compliance, account frameworks, and trust mechanisms of traditional finance, creating a global, deployable foundation. This fusion challenges legacy banks’ dominance in cross-border payments and asset management, and gives the blockchain industry a new route to escape closed ecosystems and enter mainstream markets.

Crucially, Vaulta is not just implementing its vision in theory; it is realizing it through tangible partnerships and learning from past experiences. It has forged deep collaborations with major financial institutions such as Fosun Wealth and WLFI. Fosun’s involvement underscores traditional finance’s recognition of Vaulta’s blockchain solutions—especially their potential to lower cross-border payment costs and expand asset management. WLFI’s strategic investment signals confidence in Vaulta’s novel infrastructure model. These partnerships broaden Vaulta’s real-world use cases and provide essential momentum for global compliance.

Of course, Vaulta faces real challenges ahead. Even with a fresh brand, market memories of EOS still linger. Whether users can fully move beyond the old narrative remains to be seen. And as global regulatory landscapes grow more complex, balancing innovation and compliance will remain an ongoing test for Vaulta’s Web3 banking vision.

Vaulta’s arrival does not mean blockchain has reached its ultimate solution. If Vaulta succeeds, it could serve as a significant signal for the next phase of blockchain infrastructure development. Whatever the outcome, Vaulta is now a key case study in how blockchain can intersect with—and reshape—the global financial system. Its journey demands the industry’s close attention.

Disclaimer:

- This article is republished from [BlockBeats], with all rights belonging to the original author [BlockBeats]. If you have any concerns regarding this reprint, please contact the Gate Learn team for prompt handling as per relevant procedures.

- Disclaimer: The views and opinions expressed in this piece are those of the author alone and do not constitute investment advice of any kind.

- Other language versions of this article were translated by the Gate Learn team. Without specific mention of Gate, it is strictly forbidden to duplicate, disseminate, or plagiarize the translated content.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge