BTC Price Prediction: Bitcoin Breaks $124K to All-Time High

Bitcoin Price Hits All-Time High

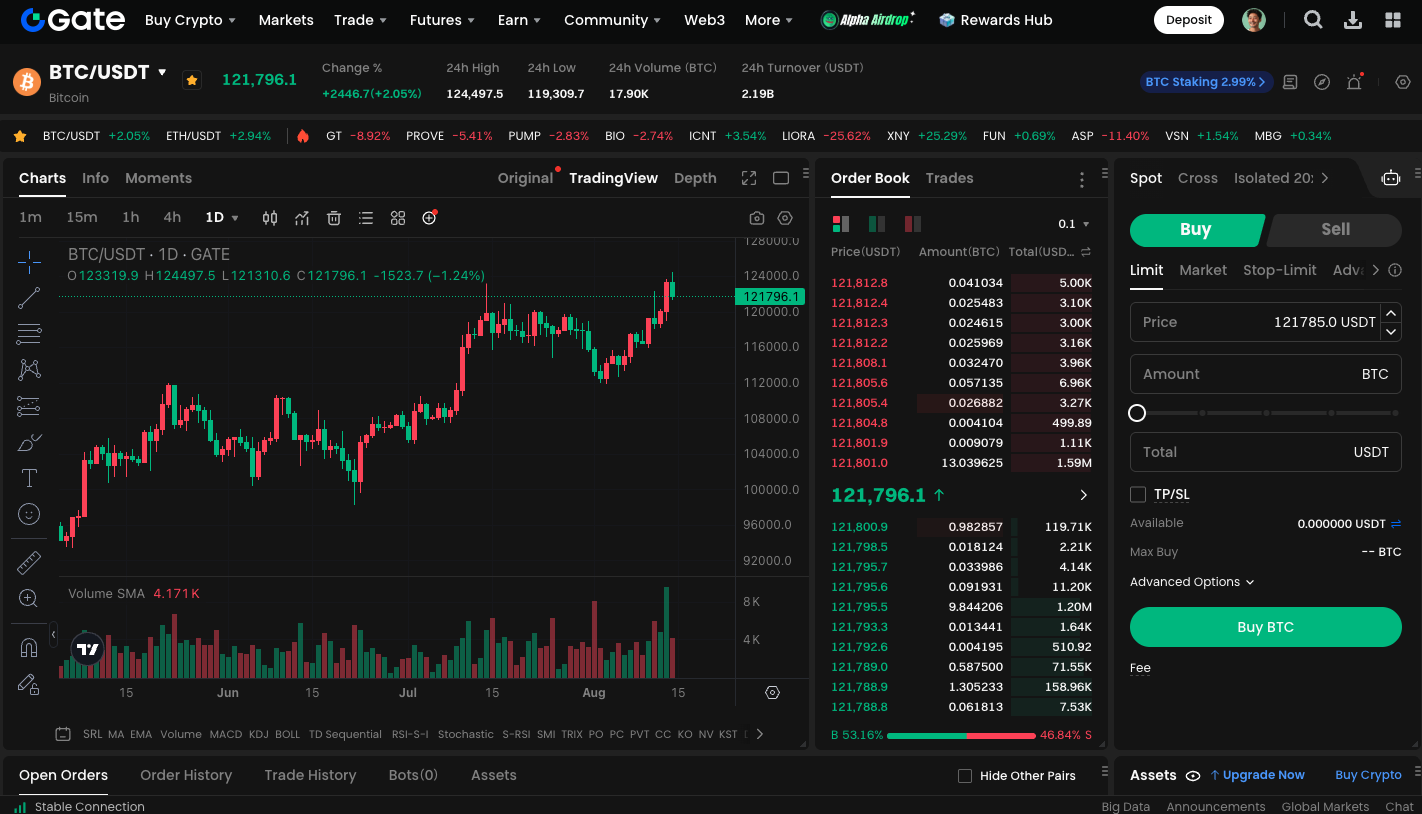

Bitcoin surged past its previous records this week, reaching as high as $124,130 and posting a weekly gain of nearly 6%. In early Asian trading, some exchanges even showed a premium, with quotes higher than major global markets. This rally not only set a new price milestone, but also lifted Bitcoin’s market capitalization to $2.46 trillion—surpassing Google’s $2.45 trillion, and placing Bitcoin as the world’s fifth-largest asset by market cap.

Key Price Levels and Technical Targets

- Upside Resistance: $124,300 serves as the main resistance in the near term; a daily close above this level could send prices straight toward $127,600.

- Downside Risk: A drop below $121,600, especially if accompanied by a rebound in miner reserves, could result in a notable short-term correction.

Analyst Rekt Capital notes that $126,000 is a major pivot point for the market, while venture capitalist Chris Burniske predicts Bitcoin could reach $142,690 in October.

(Source: rektcapital)

Macroeconomic and Institutional Drivers

The current rally is partly fueled by easing global trade tensions and persistently high US core CPI, which has increased the likelihood of a rate cut in September. At the same time, institutional inflows have hit record levels. Public companies, private firms, and sovereign entities now hold over 3.64 million BTC—worth approximately $447 billion. This accounts for more than 17% of the total supply.

ETH Moves in Tandem Toward Record High

During Thursday’s early Asian session, Ethereum touched $4,770—just 2.5% short of its 2021 all-time high. Bitcoin’s market dominance has slipped below 60%, potentially signaling the early stages of an altcoin market cycle. BTC is currently trading around $121,600. If bulls can hold key support and drive a breakout above resistance on strong volume, $127,600 may be the next target. Most analysts are considering even higher levels.

To trade BTC spot, visit: https://www.gate.com/trade/BTC_USDT

Summary

Bitcoin’s recent performance stands out, with prices breaking to a historic high of $124,130 and market capitalization rising to $2.46 trillion—overtaking Google as the fifth-largest asset by global market cap. This breakthrough not only marks a technical achievement, but also demonstrates the combined effects of strong macroeconomic conditions and robust institutional investment.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025