Is HOOD Stock Worth Buying? Full Analysis of Latest Price, Positive News, and Investment Suggestions

Definition and Background of Robinhood Stock

Founded in 2013 and headquartered in Menlo Park, California, Robinhood has fundamentally transformed retail investing in the U.S. through its zero-commission model and mobile-first user experience.

Robinhood is listed on Nasdaq under the ticker symbol “HOOD,” so “Robinhood stock” or “HOOD” is commonly used to refer to its shares. The stock exemplifies the growth potential of a new generation of investment platforms.

Stock Performance and Latest Developments

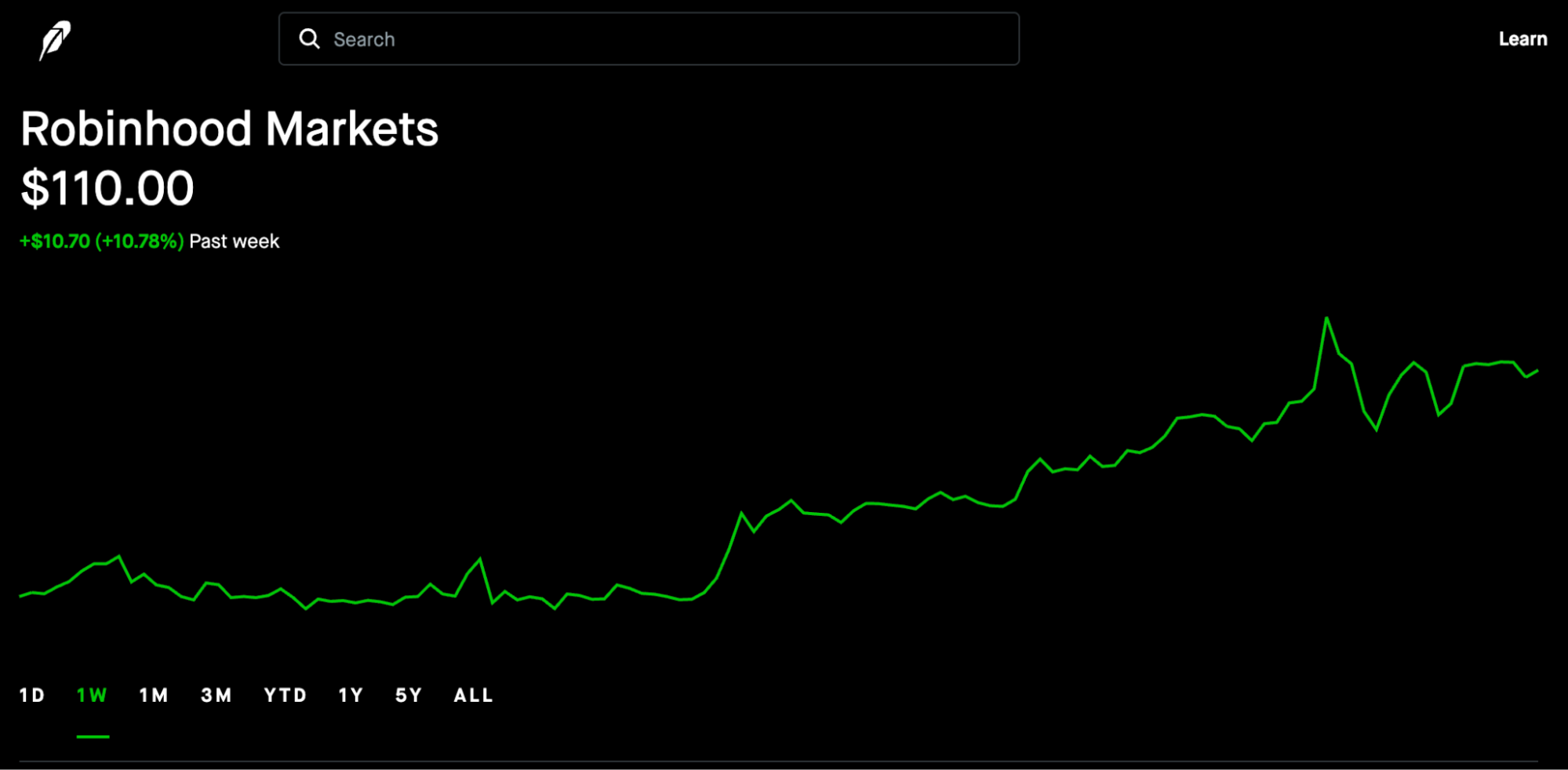

Chart Source: https://robinhood.com/us/en/stocks/HOOD/

Over the past three months, Robinhood stock has delivered exceptional results:

- The share price has surged over 50%, outperforming most other fintech stocks.

- Robinhood’s crypto-related businesses could benefit significantly from a more favorable legislative outlook in Congress.

- Rumors regarding potential inclusion in the S&P 500 have attracted increased institutional interest.

- The company plans to expand tokenized asset trading to more markets. This move signals a clear intent for global expansion.

In-Depth Investment Rationale

- Youth-Oriented User Base: Robinhood excels at attracting Gen Z investors, who typically have longer customer lifecycles and higher long-term revenue potential.

- Diversified Business Model: Robinhood has evolved beyond stock trading to offer crypto trading, debit cards, and advisory services, creating a comprehensive digital finance ecosystem.

- Optimized Profit Structure: With low operating and customer acquisition costs, Robinhood generates stable net interest income from cash balances in today’s high-interest-rate environment, often exceeding market expectations in its financial reports.

Guidance for New Investors

If you are new to investing in Robinhood stock, consider these steps:

- Begin with trend analysis. The stock is currently in an uptrend, but watch for potential pullbacks.

- Employ a buy-low, sell-high strategy. Monitor the $105–$110 range for key support and resistance levels.

- Pay close attention to the July 30 earnings report. This could serve as a short-term catalyst.

- Use Robinhood’s virtual trading feature to practice your order timing and investment strategies.

- Review analyst ratings. Several major investment banks currently rate the stock as “Overweight”; use this as supplemental input for your decisions.

Potential Risks and Mitigation Strategies

- Regulatory uncertainty: Tokenized assets remain in a regulatory gray area, which may impact revenue streams.

- High volatility driven by retail sentiment: Set take-profit and stop-loss orders to manage risk.

- Intense industry competition: Platforms like Charles Schwab and Webull are also aggressively expanding.

- Significant macroeconomic impact: High inflation or interest rate changes could dampen trading activity.

To address these risks:

- Limit the amount you invest in each position.

- Use technical indicators to identify entry and exit points.

- Regularly review your portfolio’s performance to ensure it aligns with your expectations.

Long-Term Outlook and Growth Potential

As Web3, blockchain, and fintech continue to converge, Robinhood is positioning itself as a major force in this sector. If Robinhood expands its market share and maintains regulatory compliance, it may achieve a market capitalization of over $50 billion within the next two to three years.

Summary

Robinhood stock stands out as one of the most promising growth stocks in the U.S. market. For beginner investors, it provides both an accessible entry point for learning about fintech equities and a strong platform for hands-on investing. By allocating capital prudently and executing trades with discipline, investors can capitalize on this dynamic trend.