The Exit of Fantasy.top: Is the Blast Ecosystem in Decline?

At 12 a.m. Beijing time on July 15, the decentralized card game Fantasy.top of the Blast ecosystem announced that it will migrate to the Base ecosystem and will support users in migrating their assets to the Base network.

As soon as the news broke, the community’s reaction was not one of regret, but rather a sense of “finally”—as if the ending that had long been written was turned to the last page.

Fantasy.top: The “Flagbearer” of the Blast Ecosystem

Fantasy.top is a decentralized social card game based on the Blast network, which attracts a large number of users by converting the social media performance of KOLs in the crypto field into NFT cards and combining it with gamification mechanisms. Since its mainnet launch on May 1, 2024, Fantasy.top has quickly become a star project in the Blast ecosystem.

According to DeFiLlama statistics, in the past 24 hours, Fantasy.top contributed 83% of the protocol revenue for the Blast ecosystem (approximately $10,566); it accounted for 78% over the past week and 56% over the past month. Additionally, according to Nansen data, Fantasy.top is the third highest application in terms of user transaction volume on the Blast network over the past 6 months.

The existence of Fantasy.top is an important pillar for maintaining the “activity” of the Blast ecosystem. Its migration now undoubtedly adds insult to injury for the already quiet Blast.

Not just Fantasy.top: The “Exodus Wave” of the Blast ecosystem

In fact, Fantasy.top is not the first project to flee from Blast. From the overall data and numerous cases of departure, we can clearly see the loss of projects and users in the Blast ecosystem, as well as the downward trend of Blast.

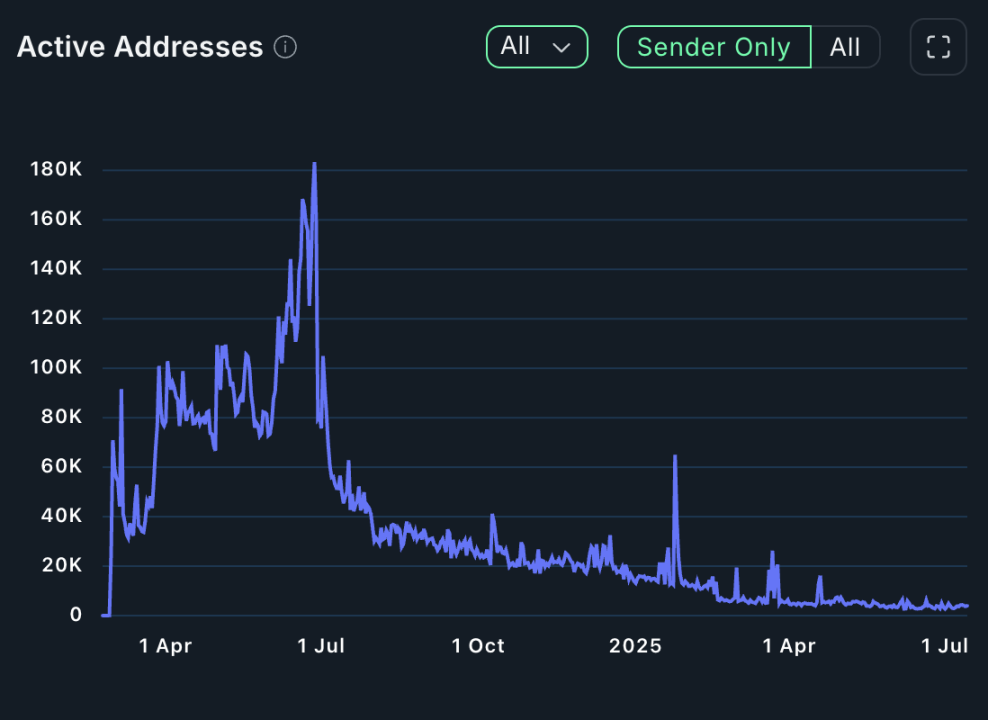

In terms of data, according to DeFiLlama, the total value locked in the Blast ecosystem DeFi is currently only $87 million, having shrunk over 95% from its peak of $2.2 billion. Additionally, according to Nansen data, the number of daily active addresses on the Blast network reached over 180,000 at the end of June 2024, but has since declined sharply, maintaining only in the range of 2,000 to 5,000 in recent months. Moreover, the daily contract deployment has dropped to double digits or just over a hundred, while the number of token deployments has even fallen to single digits, indicating a waning enthusiasm among developers.

Source: Nansen

Typical project migration case

- pump.fun: Launched on Solana in January 2024, it went live on Blast more than a month later but did not receive much attention, and after a few months, it stopped operations on Blast.

- The lottery application Megapot (gambling application, do not use) will also migrate from Blast to the Base ecosystem starting in March 2025.

- Ethos Network: Originally planned to launch on Blast, it ultimately chose to start directly on Base. Ethos Network is currently a popular reputation protocol in the Base ecosystem.

- Blast BIG BANG award-winning project Baseline: will later migrate to the Base ecosystem.

These cases point to a common conclusion: Blast is facing severe challenges in attracting and retaining projects. Despite being highly anticipated as a “native yield-bearing Ethereum Layer 2”, its ecological development has clearly failed to deliver on early promises.

Recent turmoil in the Blast ecosystem

Recently, negative signals or turmoil in the Blast ecosystem have further intensified market concerns about it:

In May 2025, Blast announced that it would not renew its service agreement with Safe, but supports accessing multi-signature wallets through BrahmaFi’s front end or self-hosted front end. Pacman explained that there are many reasons for this, one of which is that there are already many alternatives supporting Blast. However, this decision has been interpreted by outside observers as a contraction of the ecological infrastructure.

The following month, the Blast ecosystem DEX Thruster announced its decision to gradually cease operations of Thruster. The official explanation from Thruster stated that this is the result of a comprehensive assessment of Thruster’s current status, expectations, surrounding ecosystem, and future prospects. This also indirectly reflects the developers’ lack of confidence in the Blast ecosystem.

Due to the aforementioned events, the Blast ecosystem SocialFi project EarlyFans previously stated, “In light of Blast no longer renewing its service agreement with Safe and the cessation of operations of Thruster, the risks of keeping assets on the Blast network are increasing, and we have withdrawn the LP of EARLY tokens (worth $70,000) from Thruster.” Of course, in the end, EarlyFans switched to “maintenance mode” and turned to develop a fully native mobile application 8020.

A series of chain reactions indicate that the trust foundation of the Blast ecosystem is collapsing. When infrastructure collaborations break down and core applications come to a halt, developers and users will naturally choose more stable networks.

Why has Blast moved from the spotlight to decline?

Behind the fall from the peak of Blast is the cumulative effect of multiple factors:

1. The significant cooling of NFTs: Blast and Blur are deeply linked, and the cooling of the NFT market has had a huge impact on Blast.

2. Mismatch between points economy and real demand: Blast rapidly increases TVL through “deposit mining” and “points for airdrops,” but a large number of addresses are only there to farm points, and the protocol layer lacks reasons for users to stay.

3. Token Prices: The prices of BLAST and BLUR have fallen over 90% from their historical highs, severely undermining the confidence of investors and developers. In the cryptocurrency market, token prices often create a positive feedback loop with ecosystem activity, and the continued sluggishness of prices further diminishes the attractiveness of Blast.

4. Lack of Ecological Diversity: The DApp ecosystem of Blast is far less diverse compared to competitors like Base. Most users only cross-chain to earn airdrop points, and their willingness to actually interact with applications is extremely low, resulting in a continuous decline in network activity.

5. Narrative Overextension and Competition: “Native Yield” was once the core selling point of Blast, but when the market lost its novelty for this narrative and the ecosystem failed to present breakthrough applications, it was inevitable to be surpassed by competitors.

Summary

The departure of Fantasy.top is undoubtedly a footnote to the diminishing appeal of the Blast ecosystem. When incentive points are no longer universal and the narrative loses its freshness, developers will naturally gravitate towards networks that are more stable, have stronger liquidity, and boast more genuine users.

Looking back at the rise and fall of Blast, its founders attracted a group of excellent developers through early marketing, but failed to build the infrastructure and user stickiness necessary for sustainable ecological development. This once again confirms the harsh law of the crypto world: relying on short-term speculation and traffic tricks may win temporary attention, but only by truly addressing user needs and building a healthy ecosystem can one stand firm in fierce competition.

The migration trend from Blast to Base is not only a choice of a single project, but also an inevitability for the “de-bubbling” of the Layer 2 track.

Statement:

- This article is reprinted from [Foresight News] The copyright belongs to the original author [KarenZ, Foresight News] If you have any objections to the reprint, please contact Gate Learn TeamThe team will process it as soon as possible according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Other language versions of the article are translated by the Gate Learn team, unless mentioned otherwise.GateUnder no circumstances shall translated articles be copied, disseminated, or plagiarized.