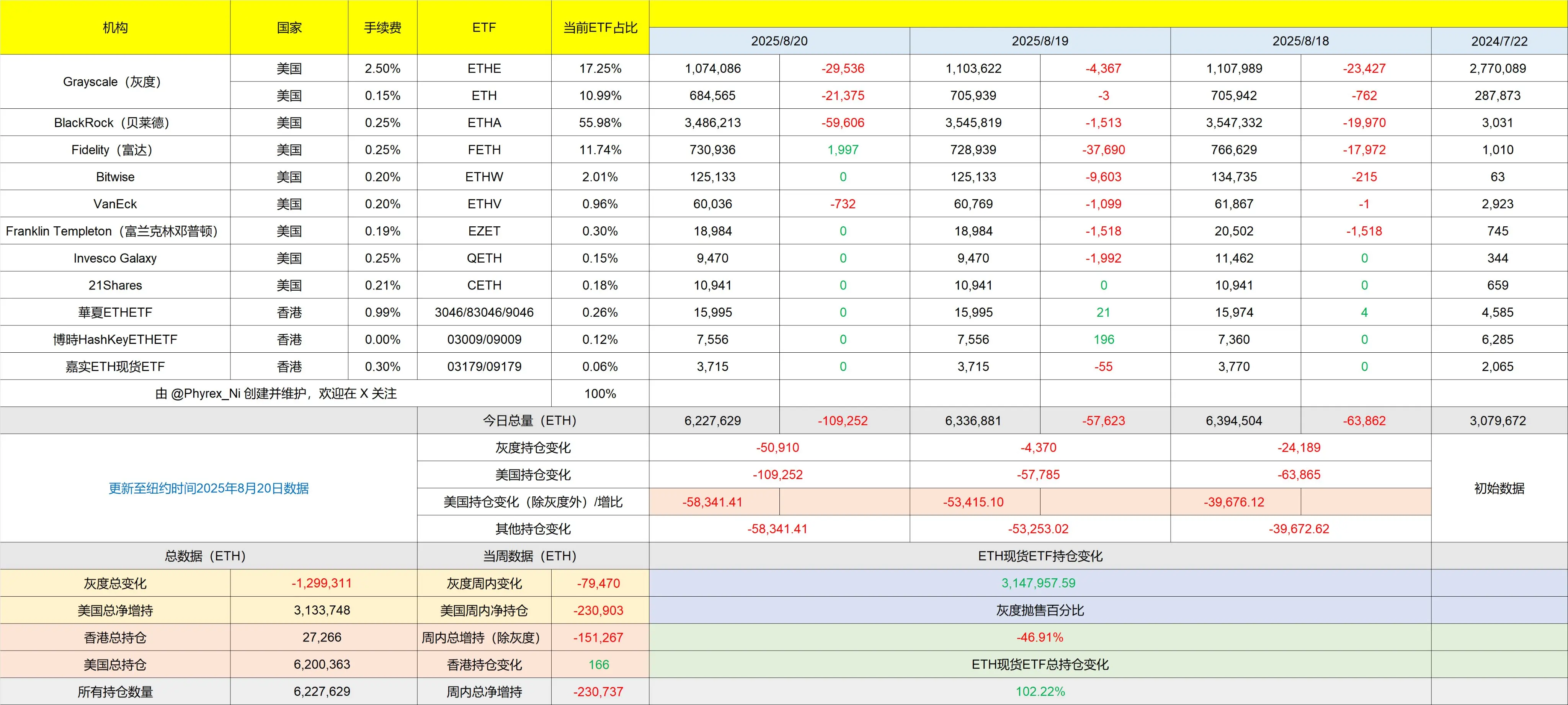

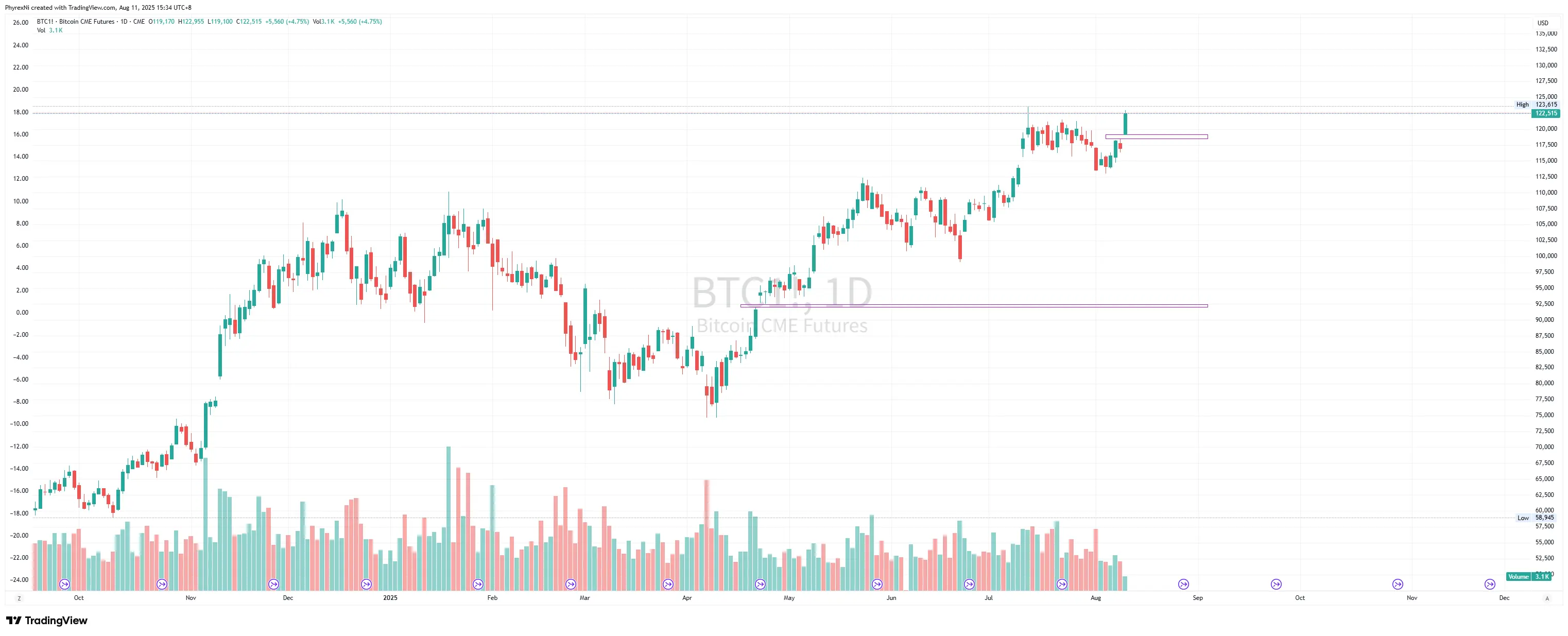

Not only is the data for $BTC poor, but there has also been a very large outflow of $ETH, with the outflow volume reaching its highest level in recent days. However, from the perspective of capital volume, the outflow funds for ETH are still lower than those for BTC. This also indicates that investors in the ETH Spot ETF have a more optimistic sentiment toward ETH compared to BTC, which is a rare advantage for ETH.

Yesterday, BlackRock and Grayscale were the main sellers, with a combined reduction of over 100,000 ETH. From a god mode perspective, today might be a bit better, after all, compare

View Original