Grvt Strategies: Building an On-Chain Institutional-Grade Strategy Marketplace for Everyone

This bull market has taken on a new and unfamiliar shape for countless users. Generating returns has become more challenging than ever. In previous cycles, simply identifying the winning narrative—DeFi, NFTs, L1 chains, blockchain games—was often enough to benefit from sector rotation and achieve rapid financial gains. Today, even as the market produces a constant stream of new narratives—Memecoins, AI+Crypto, RWA, modularity, ZK, Restaking, and more—real breakout projects are few and far between amidst a flood of new labels. The days of easy gains from indiscriminate investments and broad sector rallies are over.

Now, as the market becomes more selective and emotional cycles turn measured rather than euphoric, both hype and positive catalysts are losing steam. True wealth-building opportunities are becoming extremely rare.

This evolution in investment pace is deeply reshaping the broader crypto community.

In this cycle—where finding high-quality assets is more challenging than ever—an explosion of token-picking KOLs has swept the space, saturating the community with endless recommendations and airdrop guides, making information increasingly difficult to discern. Some are experienced, trustworthy analysts; others are simply looking to profit at the expense of retail traders. For everyday investors, sifting through this clutter to distinguish fact from fiction and assess motives can take more time and energy than the investment decision itself.

Is there a solution that cuts through the spin and lets data and track record speak for themselves? Is there a tool that empowers retail investors to use institutional-grade strategies—where performance is transparent, options are comparable, and participation feels confident?

On July 16, 2025, Grvt—the world’s first licensed on-chain derivatives exchange—officially launched “Grvt Strategies,” the world’s first compliant on-chain peer-to-peer (P2P) strategy marketplace.

Grvt zeroed in on today’s core challenge: retail users lack access to strategies, can’t easily verify information, and have no way to track real trader performance. Grvt Strategies solves this by turning professional trading strategies into a transparent, verifiable, reusable, and open market—where institutional methods are clearly priced and accessible to all.

As Grvt co-founder Hong Yea puts it, “Wealth creation should be as simple as sending a text or booking a ride.” This is not just a motto. It is an actionable approach to increasing market transparency and lowering the bar for retail participation.

Where the last bull market was a speculative frenzy, now is the time to use strategy to address uncertainty and systematic thinking to replace KOL noise. Grvt Strategies is leading that transformation.

Accessibility and Transparency: Investment Strategies as Simple as Online Shopping

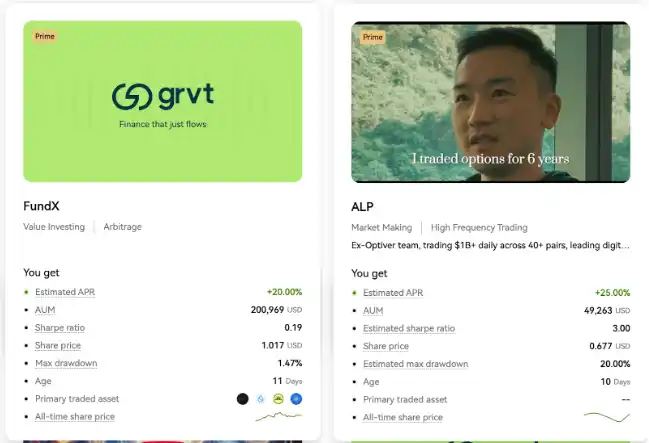

Grvt Strategies reimagines the investment platform experience, abandoning the convoluted dashboards common in traditional finance and DeFi. Instead of overwhelming users with APY, TVL, or vault metrics, Grvt provides a clear, intuitive, and structured list of strategies. Each includes a concise overview, historical performance, risk models, and more. Like shopping online, users can filter and select strategies based on type, projected annual returns, maximum drawdown, asset class, and other parameters.

Traditionally, most quality investment products and structured strategies were reserved for institutions or high-net-worth individuals—and those options were often buried under complex structures, keeping them out of reach for retail.

Unlike legacy finance and many DeFi products, Grvt Strategies operates entirely on-chain and uses smart contracts to automate the flow of capital. Every trading logic and rule is fully transparent and on-chain for anyone to audit. Users can trace not only historical performance but also exactly how funds are deployed, when trades are executed, and how and when profits are distributed—without trusting any middlemen. Most importantly, Grvt Strategies is non-custodial: users’ funds remain under their own wallet control and can never be misused by the platform or managers.

Neither the high barriers of traditional finance nor the incomplete toolkits of most DeFi vaults have met the needs of ordinary investors. In this market gap, Grvt Strategies offers a solution—consolidating professional-grade strategies in an open marketplace and making barrier-free investing possible.

Grvt Strategies launched after careful preparation. Its initial lineup features six highly experienced strategy managers with proven results and diverse backgrounds in traditional finance and quant trading. Among them: Ampersan, with founders formerly from global market maker Optiver and over $400 billion in trading volume; b-cube.ai, an AI-driven crypto quant platform run by a VASP-regulated team; Meerkat, a Cambridge math Ph.D.; and top-performing traders who have ranked among the most profitable on Binance and Bybit.

This Isn’t Copy Trading—It’s Real-Time, Synchronized Trading

Grvt Strategies breaks from the limitations of copy trading, guaranteeing that retail users and strategy managers execute trades at the same moment.

Traditional copy trading suffers from lag and price slippage: when a lead trader buys, copy traders wait for trades to be executed in their accounts. If prices swing sharply, copy traders may enter at a worse price or miss the trade completely—making those critical seconds especially costly in high-frequency markets. Repeat this process and returns are quickly eroded.

Some KOLs exploit this lag, using main accounts to trigger buy signals for followers, then offloading positions across other accounts—resulting in losses for copy traders.

Grvt Strategies eliminates this lag completely. Instead of copying, all investors participate in the same smart contract transaction simultaneously —no delays, no slippage. Everyone’s funds, including those of the strategy manager, are pooled and executed together for identical trade prices and returns.

Whereas copy trading is typically limited to basic strategies and can’t support high-frequency or quant approaches, Grvt Strategies enables managers to execute sophisticated automated on-chain strategies—like quant algorithms, HFT arbitrage, or hedging—directly through smart contracts. Retail investors just connect to the contract once to participate; they don’t have to copy every trade manually.

In short: classic copy trading is “I copy after you buy.” Grvt Strategies is “we buy at the same time.”

Innovation and Compliance: The First P2P Investment Marketplace

P2P has long been hailed as one of fintech’s most disruptive innovations, bypassing financial intermediaries and enabling ordinary users to interact directly—transforming costs, efficiency, and access.

But for years, P2P was limited to lending, both in Web2 and Web3, focused solely on matching borrowers and lenders for agreed rates and capital flow.

The next-level P2P vision—direct connection and risk/reward sharing between capital owners and strategy drivers—didn’t materialize until now.

Grvt Strategies is changing that, bringing P2P to investment for the first time. This is not only a technical breakthrough, but a sweeping overhaul of both product and compliance frameworks. On Grvt Strategies, investors browse, select, and directly sign one-to-one smart contracts with their chosen strategy managers—funds are enrolled in execution automatically. As a licensed on-chain derivatives platform across multiple jurisdictions, every Grvt strategy is designed and run within full compliance, giving users unmatched peace of mind.

This kind of innovation is powered by advanced on-chain technology and rigorous compliance, with smart contracts and blockchain transparency at its core. Layer 2 scaling solutions such as zkSync provide the efficient, low-cost, and cross-chain backbone that makes it all possible.

As a fully licensed derivatives platform, Grvt sets the standard for compliance. All strategic products must pass KYC, AML, historical performance reviews, and robust risk model testing. Managers have to clearly disclose trading philosophies, asset allocations, and risk controls—and are subject to ongoing oversight by Grvt’s internal risk team. User assets are never held by the platform, but directly managed via contract—so no one can ever misappropriate funds.

Grvt also offers fiat on-ramps, letting users purchase stablecoins via bank transfer or credit card. Retail users skip the hassle of registering a crypto wallet or hopping between platforms, facilitating a seamless transition from Web2 to Web3.

The next generation of finance is a collaborative, on-chain network—where everyone has access to professional strategies and can participate directly. If early DeFi was an experiment, Grvt Strategies is an accessible gateway to on-chain investment opportunities.

Disclaimer:

- This article is republished from [BLOCKBEATS]. Copyright belongs to the original author [BLOCKBEATS]. If you have concerns regarding republication, please contact the Gate Learn Team. We will address your inquiry as soon as possible.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions were translated by the Gate Learn Team. Without express attribution to Gate, reproduction, distribution, or plagiarism of these translations is strictly prohibited.